Waste-to-Energy Project Finance Consulting

At Amimar International, we specialize in comprehensive project financing advisory services for waste-to-energy (WTE) facilities across North America and select markets worldwide. Project range: $5M-$200M.

Why WtE, Why Now — And Why Amimar

Waste-to-Energy (EfW) projects are entering a pivotal phase: municipalities need resilient waste-management capacity as landfills tighten; grids value firm, dispatchable low-carbon power; and district heating networks are accelerating waste-heat integration. In 2025, the global WtE market is estimated around US$40–51 billion with mid-single-digit CAGRs projected through the next decade, underscoring continued investor appetite for projects that pair contracted feedstock with predictable energy and heat revenues.

At Amimar International, we translate these market forces into bankable capital stacks. We guide sponsors from early feasibility through financial close, aligning permits, feedstock agreements, technology selection, EPC/long-term O&M, energy/heat off-takes, and (increasingly) Carbon-Capture-and-Storage (CCS) add-ons — so lenders can underwrite stable cash flows and well-mitigated risks.

2025 Market Signals Sponsors Should Leverage

-

Carbon Capture at EfW is financing-ready. In September 2025, the UK government signed contracts enabling Encyclis’s Protos EfW CCS project (Ellesmere Port) to proceed toward construction as one of the first carbon capture anchor projects in the HyNet cluster—together expected to remove ~1.2 Mt CO₂/year across two industrial sites, with Protos’ captured CO₂ transported for storage in Liverpool Bay. This establishes a commercial framework and a blueprint lenders can diligence on upcoming EfW-with-CCS transactions.

-

Heat offtake value is rising. European district-energy mix is shifting rapidly; renewables and waste-heat now represent ~44.1% of the DHC energy mix (up 9.4% since 2022), improving the bankability of long-term heat sales linked to EfW plants.

-

Converging clean-infrastructure capital. DFIs and IFIs remain active in the wider waste/clean-energy ecosystem (e.g., ADB and IFC engagement with leading Asian waste platforms), keeping liquidity accessible for qualified sponsors and encouraging best-practice E&S frameworks that reduce financing friction.

What this means for you: robust precedents for CCS-ready term sheets, more District Heating Agreements (DHAs) priced to inflation, and multilateral participation that can lower overall cost of capital for well-structured projects.

Waste-to-Energy Project Checklist (Permits, Documents & Agreements)

-

Land Tenure & Zoning: Proof of freehold/long lease, zoning that permits WTE/industrial use; easements and access rights.

-

Environmental Approvals: EIA/ESIA completed with public consultation; air emissions permits; environmental compliance certification.

-

Waste & Feedstock: Long-term Municipal Solid Waste (MSW) Supply Agreement or private hauler contracts with minimum tonnage and quality specs (calorific value, moisture, contamination limits) plus put-or-pay constructs or availability-style gate fees.

-

Grid & Heat Interconnection: Grid Connection Agreement and (if applicable) District Heating Connection Agreement with thermal capacity, temperature regime, and metering/settlement terms.

Source: Time Van de Velde

The Impact of Technology on Waste-to-Energy Financing

The choice of technology is a crucial aspect of waste-to-energy project financing, as it can have a profound impact on various factors such as costs, efficiencies, and environmental impacts. Different technologies come with their own set of advantages and disadvantages, all of which can ultimately influence the financial viability and attractiveness of the project to potential investors.

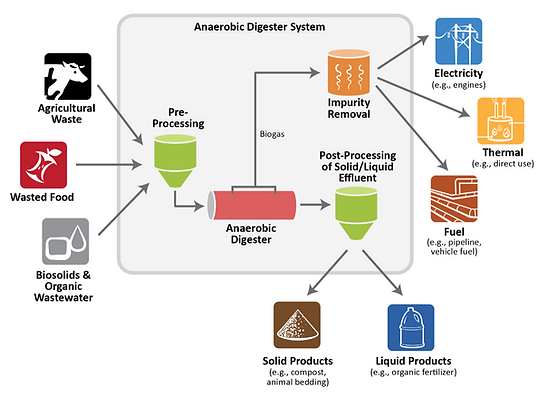

In recent years, emerging technologies in the waste-to-energy sector, such as advanced thermal treatment and anaerobic digestion, have shown promise in offering higher energy recovery rates and reducing environmental impacts compared to traditional incineration methods. While these technologies may offer significant benefits, they often come with higher upfront costs that can impact the overall financing structure and return on investment of the project.

Furthermore, as technology continues to evolve and improve, there is the potential for cost reductions and efficiency enhancements to occur over time. These advancements can not only improve the overall financial performance of the waste-to-energy project but also make it a more attractive opportunity for investors looking to support sustainable and environmentally friendly initiatives. As such, the selection of technology is a critical decision in waste-to-energy project financing that can have a profound impact on the overall success and outcomes of the project.

Financing Options & Capital Sources for WTE Projects

Debt Financing Solutions

Traditional Project Finance:

-

Senior debt facilities with tenors matching PPA terms (15-25 years typical)

-

Construction-to-permanent financing with single closing structure

-

Interest rates currently ranging from 6.5% to 9.5% depending on risk profile

-

Loan-to-cost ratios up to 75% for projects with strong fundamentals

Specialized WTE Lenders:

-

Infrastructure debt funds with renewable energy focus

-

Canadian pension fund direct lending programs

-

Export credit agencies for international technology procurement

-

Green bonds and sustainability-linked financing facilities

-

Government incentives & support programs

Equity Investment Sources

Institutional Equity Partners:

-

Infrastructure funds targeting 12-18% IRR on WTE investments

-

Pension fund direct infrastructure investment programs

-

Private equity funds with energy transition mandates

-

Family offices and high-net-worth individuals seeking ESG investments

Strategic Investors:

-

Utility companies expanding renewable generation portfolios

-

Waste management companies integrating energy recovery

-

Engineering firms seeking long-term asset ownership

-

Government entities through crown corporation partnerships

Equity & Sponsor Requirements

While each jurisdiction and lender set differs, WTE greenfield projects typically target 25–35% equity at notice-to-proceed, stepping up where technology or feedstock quality is less proven, or where CCS integration is simultaneous rather than phased. Sponsors should plan for:

-

Demonstrable track record in infrastructure delivery or a tier-one EPC/O&M partner that covers any experience gaps.

-

Contingency capitalization (owner’s contingency) above EPC contingency for latent ground conditions and supply-chain inflation.

-

Early procurement locks for long-lead items (boiler island, flue-gas cleaning, steam turbine) and CCS-ready interfaces to avoid later re-work.

Where equity depth is constrained, Amimar can structure stapled mezzanine, preferred equity, or ECA-backed vendor financing to right-size the stack without sacrificing bankability.

Frequently Asked Questions

Ready to explore financing solutions for your waste-to-energy project? Our experienced team is available to discuss your specific requirements and develop a customized approach to achieving your development objectives. Contact us today to schedule a confidential consultation and discover how our expertise can accelerate your waste-to-energy project development timeline while optimizing financial outcomes.